The automotive market is continually evolving, and environmental and economic pressures are increasingly demanding the industry to shift towards sustainable solutions and lower carbon emissions. The Electric Vehicle (EV) market is one of the fastest growing to have emerged in recent years, as this sector adapts to public and market demands, the whole supply chain is working to flex to these changes, with considerable developments being made in technology, cost-saving initiatives and lightweighting techniques.

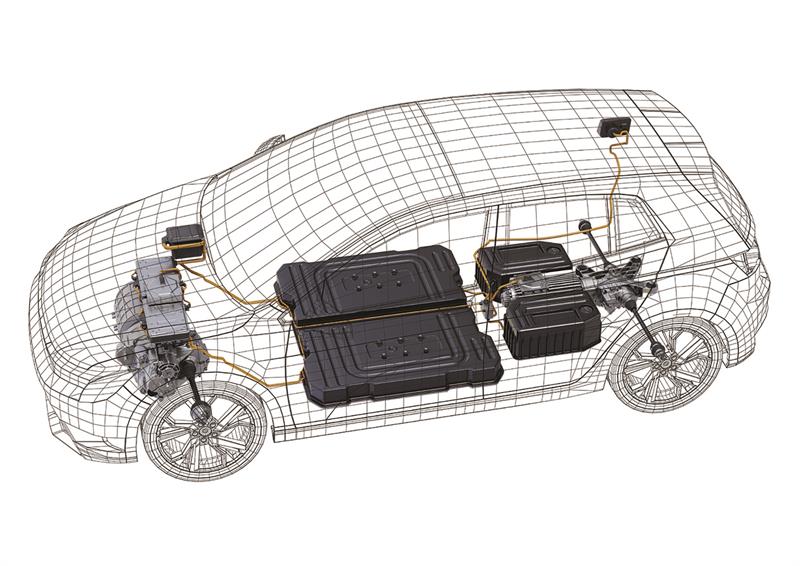

The role of fasteners in this bigger picture around EVs is not insignificant: Not only are fasteners needed for the vehicles themselves, but charging units, EV battery casings and general infrastructure equipment all require fasteners to provide robust and secure settings for this valuable technology.

In this article we look at the rapidly developing EV and EV Battery (EVB) sectors and how fasteners are helping to shape the future of this exciting new chapter in automotive and electronic history.

The industry landscape

According to BloombergNEF’s latest Electric vehicle Outlook report, published in January 2019, 57% of all global passenger vehicle sales and 30% of the global passenger vehicle fleet will be electric by 2040. 2 million EVs were sold worldwide in 2018, and this number is expected to rise to 10m by 2025, 28m by 2030 and 56m by 2040. The growth in this sector has been rapid, rising quickly into the millions, a far cry from 2010 when only a few thousand EVs were sold across the globe.

An obvious factor in this market growth is the significant development of the technology, both in terms of the vehicles themselves and of the infrastructure and accessories needed to support them. However, infrastructure remains a major challenge for the sector, as the chicken and egg dilemma of supply vs demand continues to amount to far fewer charging points than needed being installed.

The charging structure

Charging is an essential part of the wider EV story: after all, if there are more EV cars being used, more charging connectors and locations will be required. If the Bloomberg predictions for the next three decades become reality, this in turn will generate a requirement for six times more EV charging locations than are currently available.

According to the UK charging point platform, zap-map.com, there are currently (as of 23 July 2019) 24,658 charging connectors, in 14,502 devices, at 9,109 locations across the UK. The total number of connectors has increased from just over 13,000 in November 2017 to more than 24,500 in July 2019, a 90% increase in just 20 months.

This growing consumer demand, coupled with the rapid development of EV and EVB technology, has enabled TR Fastenings to combine its fastener product range and knowledge into a package to support and contribute to these ground-breaking sectors.

Andrew Nuttall, global account director at TR comments: “The EV and EVB markets are such exciting, fast-moving sectors and the resulting impact on global supply chains in both the automotive and electronic industries has been huge in terms of demand and opportunity. It’s a real privilege to be involved in such a cutting-edge field, delivering our products and knowledge to start-ups, OEMs and Tier 1 suppliers developing transformative technologies such as longer lasting batteries, lightweight solutions and connected devices.”

EVB: the latest growth area

As EV adoption continues and the infrastructure to support this develops, thoughts are also turning to the technology within the vehicles. The battery sector (EVB) is naturally the major focus for growth, as battery and lithium prices continue to drop, and significant investment is made into new chemistry and technology, such as single state battery development.

According to Bloomberg’s EV Outlook forecast, “Lithium supply looks sufficient until at least the mid-2020s, but new cobalt and nickel mining capacity will need to come online to meet growing demand. Solid state batteries are still a decade away from use in mass-produced vehicles, but steady advances in the current family of lithium-ion batteries will bring continued improvements in energy density.”

Another concern in terms of EVB is lightweighting: as one of the heaviest components in an EV, the electric battery runs the risk of negating the idea of carbon emission reductions if the vehicle’s weight increases energy consumption. As a result, fastener companies and other members of the supply chain are constantly looking at ways to achieve gains in lightweighting, looking to industries such as aerospace for inspiration.

Nuttal says: “At TR, we work with Tier 1 suppliers such as seat manufacturers to ensure that where possible lightweight solutions, such as the Mortorq screw we are licensed to manufacture by Phillips, are used throughout vehicle applications to make weight savings and counterbalance the impact made by the battery weight.”

Fastening technology is crucial for EV and EVB manufacture, TR’s range includes a number of parts which are particularly relevant for EVB assembly, such as:

- Fasteners with electrically isolating coatings

- Lightweight non-magnetic fasteners

- Battery retention bolts

- Cable management hardware

- Compression limiters

In addition, its branded ranges comprise every component listed in a typical Bill of Materials (BOM) for EV charging units, including:

- Sheet metal fasteners

- Thread-forming screws for plastics/metals

- Plastic hardware

- Enclosure hardware

- Security fasteners

- Standard fastenings

- Cable management parts

- Specials and bespoke designed fasteners

Also relevant for the EV market is presswork, such as brackets and bus bars, a commodity that TR has been developing over recent years and has a strong supply chain ready for the growth in this area.

Early engagement in design

For the ‘electric highway’ initiative to be successful, manufacturers and sub-contractors must work together early in the development process, specifically right from the start, to ensure the correct Design for Manufacturing (DfM) considerations allow customers to make the best-informed decisions. Discussing cost-efficiency, sourcing and product lifecycle issues at the design table means that potential difficulties can be identified and addressed early, avoiding later costly delays.

Ian Carvell, UK engineering manager at TR, adds: “The EV sector is dominated by a number of start-up companies and innovators from different industry sectors. Our engineers regularly partner with companies at concept stage (in many cases three years prior to SOP), using our knowledge of fastener strategy, fastener standards and fastener design rules and their knowledge of the industry and parts to leverage high volume products common in the automotive and aerospace sectors.”